Quarterly CIO Letter: Fourth Quarter 2022

We believe the outlook for the economy remains highly uncertain and the risks to the market and economy remain to the downside. There are a growing number of potential black swan events, the fruition of any of which would be catastrophic.

However, the market seems to whole-heartedly disagree. The fourth quarter was incredible for equity markets with the Dow Jones Industrial Average up over 15% and the S&P 500 up 7%. However, under the surface there was a more risk-off tone with the growth factor and the NASDAQ composite continuing to lag the overall market. The rally in October and November was fueled by investors hanging on every shred of hope the Federal Reserve will stick the landing and be able to pivot. In the same tune, bad news has become good news again and the market is discounting none of the fat tail risks—the Ukraine war turning nuclear or becoming a world war, the deteriorating relations between China and Taiwan and the developed world, the excessive amount of debt in the system, the debt ceiling debate coming back into play, and the list goes on. The markets aren’t even discounting the risks with higher probabilities today—a recession or persistent stagflation. Reality began to set back in for December, but January has been back off to the races thus far. Thus, the title of this letter, “Betting on Nirvana”. We continue to believe that eventually the bill comes due.

Figure 1 Source: Y Charts

Figure 2 Source: Y Charts

The Federal Reserve already made a policy mistake by leaving rates near zero for far too long. Once they awoke from denial, the environment necessitated rapid and front-loaded measures to alleviate inflationary pressures. The risk with moving so quickly is monetary policy acts with long and variable lags before the effects of each policy move begin to be felt. Tightening so many times, so quickly, and by so much without letting the effects of the last hike take hold leaves a lot of room for the next policy mistake—going too far.

The economy was already beginning to slow as the rate hike cycle took hold. Higher prices of necessary goods left little in the pockets of consumers for discretionary purchases. We believe the Federal Reserve is likely to pause rate increases this year as our leading economic indicators are suggesting economic conditions are deteriorating; however, we see rates staying higher for longer due to elevated inflation.

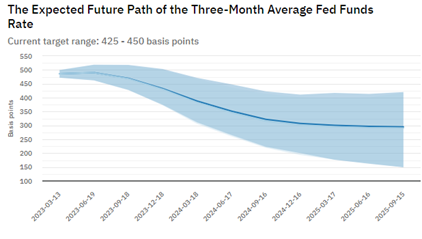

At the last policy meeting of 2022, Jerome Powell made it clear its policy rate would most likely be above 5% by the end of 2023. The markets have refused to price that in and instead are putting a high probability on the Federal Reserve cutting rates at least once by December, disregarding every word Powell is uttering. Not one Fed official has projected cuts in 2023. Talk about fighting the Fed.

This could be because investors expect a recession or because they believe the Fed will be able to walk the, ever narrowing, fine line between slowing growth enough to calm inflation and not enough to send the economy into a recession. Based on the market’s Q4 performance, I believe it is the latter scenario. The irony is the Fed has lost enough credibility for everyone to ignore their very clear message that they are not cutting rates, but the market is trusting the Fed is good enough to thread this needle. This may be due to the Behavioral Economics concept of “recency bias”—overemphasizing recent experiences relative to older experiences. The “Fed Put” has been in place for so long, investors refuse to believe it will not be there this time around. We believe this pivot is mythical and will only occur if the Fed goes way too far and the economy falls off a cliff. If they go that far, there will be deep implications.

Figure 3 Source: Atlanta Fed Market Probability Tracker

The Federal Reserve mandates are full employment and price stability. They have fulfilled the full employment piece, but currently get an “F” for price stability. The primary goal of the Federal Reserve today remains taming inflation, even if this causes economic pain. The hard part has not even come yet. When the Fed needs to pick between the two mandates while they are both moving in the wrong direction, that is going to be uncomfortable. The problem is not just in the US, but globally as central banks worldwide try to land the delicate balancing act of high inflation in the face of slowing growth expectations.

Because easy monetary policy and fiscal stimulus persisted so much longer than was necessary, inflation became deeply entrenched in the system. Once this occurs, it is difficult to undo, especially if a wage-price spiral takes hold. Inflation has taken hold in “sticky” goods and services. Historically a change in the direction of sticky inflation has required a recession (Figure 4).

Figure 4 Source: Atlanta Fed

The market rallied strongly on the December jobs report released in January. Job growth was strong, and the labor force participation rate ticked up, signaling we may have found a wage level high enough to entice people off the sidelines and into the labor force. A continuation of this increase in labor force participation rate would act as a relief valve for the tight labor market. The market interpreted the softening average hourly earnings number as confirmation wages have peaked. The Fed stuck the landing, softening wage growth while the labor market remained fully employed. We are not convinced. Although this was a good data release, it was one month, and it is distant from stable growth.

The more interest rate sensitive sectors like housing and technology saw an increase in layoffs. Three leading indicators of the labor market (which itself is lagging) are showing softening as well. Temporary help has declined significantly, and manufacturing overtime hours fell to their lowest level since 2007, aside from the pandemic. The decline in average hourly earnings was likely impacted by this decrease in higher paid overtime hours. The average workweek has also fallen. Typically, these series lead the labor market as they are the low hanging fruit.

Figure 5 Source: St. Louis Fed

Figure 6 Source: St. Louis Fed

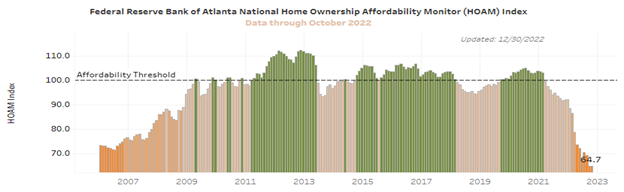

Housing was quickly impacted by rising interest rates as they directly affect the affordability of homes for individuals (Figure 7). Is this indicative of what will happen to the rest of the economy as those long and variable lags catch up with the data? The yield curve has been inverted for an extended period now, signaling concern about the sustainability of the economic cycle. A yield curve inversion historically has led the market by 6+ months, and the economy by more. If the yield curve inversion holds true, some meaningful pain in the markets could be ahead.

Figure 7 Source: Atlanta Fed

The pandemic changed the world in many ways and sped up trends already playing out. Demographics and the great resignation of the baby boomers are confirming our long-held belief that baby boomers retiring would be inflationary. Intellectually, this makes sense as it shrinks the number of producers relative to the number of consumers. Automation can help counteract this issue and will work well alongside deglobalization to help bring supply chains closer to home.

Deglobalization has many implications. While we don’t think we are reverting to a fully insulated world, we believe globalization has peaked and the world will become more fragmented. This shrinks potential global growth and decouples economic cycles. It is also inflationary as goods are not produced by the country with the best competitive advantages, competition is reduced, and currency becomes less of a mechanism for shifting supply and demand dynamics. In the past a country could import deflation by buying goods from a country with more economic slack, typically emerging markets. Without this release valve, more frequent bouts of inflation are likely and with that, likely shorter and more muted economic cycles. Just-in-time inventory also ties into this as companies are realizing the efficiencies gained by holding less inventory create supply bottlenecks in times of stress. This is another dissipating corporate margin tailwind. Bringing supply chains closer to customers is a tailwind for automation and a great opportunity for countries like Mexico to take production away from countries like China. Unfortunately, as countries become more insulated and less economically interdependent the world may become less peaceful.

These trends have implications for Emerging Markets which have historically had two growth avenues: 1) resource driven growth for countries with abundant natural resources or 2) being a low-cost production hub. Automation and deglobalization could alter that second path to sustainable growth for emerging markets. Unfortunately, this path is typically the more stable, sustainable, fruitful, and peaceful one. Global growth is likely to be lower going forward, requiring emerging markets to create their own demand domestically to some extent if they want to continue to grow. The strong dollar, higher inflation, and slower economic growth have been detrimental to emerging markets. Several frontier and emerging countries are already in default and many others in need of debt relief soon. This new world is likely more challenging for these countries.

How are we positioning our clients’ portfolios in this environment?

We invest based on a range of 15% on either side of our benchmark equity and fixed income allocations for each client objective. Our client accounts are at the low end of the equity range and the high end of the fixed income range. We decreased our equity and risk exposure quite a bit over the fourth quarter as we took advantage of the market rally. Within equities we have a value, quality, and dividend yield tilt to the portfolio as well as exposure to beneficiaries of both inflation and infrastructure spending.

The world has fundamentally changed. What worked for the past several decades is unlikely to work today. Higher inflation and subsequently higher interest rates along with, supply conditions which will keep commodity costs elevated, demographics which will keep the labor market tight, quantitative tightening, and deglobalization will all have impacts on potential GDP growth and inflation globally. Furthermore, the more value-centric industries and sectors have seen underinvestment while the more growth-oriented sectors have experienced overinvestment. The strong growth of the Fed balance sheet since the financial crisis was a big driver of growth stock outperformance. Business models of these growth companies were predicated on unlimited quantities of free money. Money is no longer free and there are beginning to be consequences. With the Fed only barely beginning to unwind the balance sheet, this could be a long and painful road. Growth stocks may be stuck in purgatory for the foreseeable future. Growth earnings estimates remain high, and multiples need to continue to re-rate.

Heading into a recession is typically not the time to be buying small caps. While we remain underweight to small caps versus our benchmark, we are building a small cap value position for a few reasons:

1) Small caps are less exposed to a strong dollar.

2) Small caps are more insulated from geopolitical risk, growth shocks outside of the US, and the global supply chain.

3) Valuations are more reasonable relative to large caps, and specifically with the valuation discipline that our manager uses, I know we are not overpaying for companies here. The spread between small and large caps is attractive today and it reminds me of the regime shift coming out of the tech bubble where you wanted to be in small cap and value.

4) Small caps earnings have been more resilient thus far in this economic slowdown than large caps. For the reasons in bullets one and two I think this can continue.

We also have exposure to the low volatility factor. We believe our holdings have attractive downside capture ratios and in times of volatility they have done their job very well. We have also been increasing our defensive allocation through consumer staples, healthcare, and utilities when we have seen opportunities to do so. We maintain a quality tilt to the portfolio and want those stable companies with healthy corporate balance sheets, high free cash flow, and stable revenues and margins. These types of companies tend to do well in both stagflationary and recessionary environments.

We remain meaningfully underweight international markets, though we are looking to begin closing that gap. Valuations are relatively more compelling internationally and some opportunities are beginning to emerge. However, international economies are also dealing with very elevated inflation readings and slowing economies. For most developed economies, their demographics are worse than in the US. China also is exhibiting some signs of trouble in the property sector which need to be monitored closely. We will be very selective in our international positioning given the risks in the current environment.

Within fixed income we remain very short duration, though we are nibbling at the long end of the curve. We brought our cash buffer down substantially in Q4 and are utilizing very short-term treasuries (<90 days) as a cash proxy while picking up a yield above 4%. When opportunities emerge, we will put that money to work. We have bought back some TIPs over the last few months as well. We have some short-term corporate exposure but, aside from CCC and below, we really haven’t seen the spread widening that would be consistent with the market pricing in an economic slowdown.

Figure 9

We believe volatility will persist in 2023 given that we expect the economy continuing to weaken. Some interesting investment opportunities are unfolding that we are monitoring closely. We have plenty of dry powder to deploy when the time is right. There is a lot of uncertainty, but one thing we are certain of is that the global landscape is changing. With change comes pain, but also a lot of opportunity if one is positioned appropriately.

In this environment, it is important to stay disciplined and keep long-term goals in mind. If you don’t know what your goals are, it is much more difficult to understand whether you are on track to meet them. We encourage our clients to take advantage of our financial planning capabilities to gain clarity.

As always, please reach out with any questions.

Kasey & Marc

MGO One Seven LLC (“MGO One Seven”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. Services are provided under the name Stone Creek Advisors, LLC, a DBA of MGO One Seven. Investment products are not FDIC insured, offer no bank guarantee, and may lose value.