Quarterly CIO Letter: First Quarter 2023

UNDER THE SURFACE

The first quarter contained two of the three biggest bank failures in US history as well as the downfall of Credit Suisse (we covered these events in our mid-quarter update). Additional risks continued to brew under the surface. Geopolitical tensions increased (North Korea, Russia, and China), OPEC+ production cuts shocked the markets, and the debt ceiling debate was not solved. Fixed Income and equity markets experienced quite a volatile ride caused by increased uncertainty of the future trajectory of monetary policy. February printed a hot January inflation reading and expectations that the Fed was not done raising rates resurfaced. However, the banking crisis unwound that expectation. Investors speculated the crisis would fuel tighter lending standards, potentially finishing the Fed’s job for them and allowing the Fed to significantly cut rates later this year. By month end, the banking sector risk seemed contained and risk assets continued their climb up the metaphoric “wall of worry”. Will one of the bricks come loose? The bond market seems a bit more concerned than the stock market. Time will tell.

First Quarter Index Performance

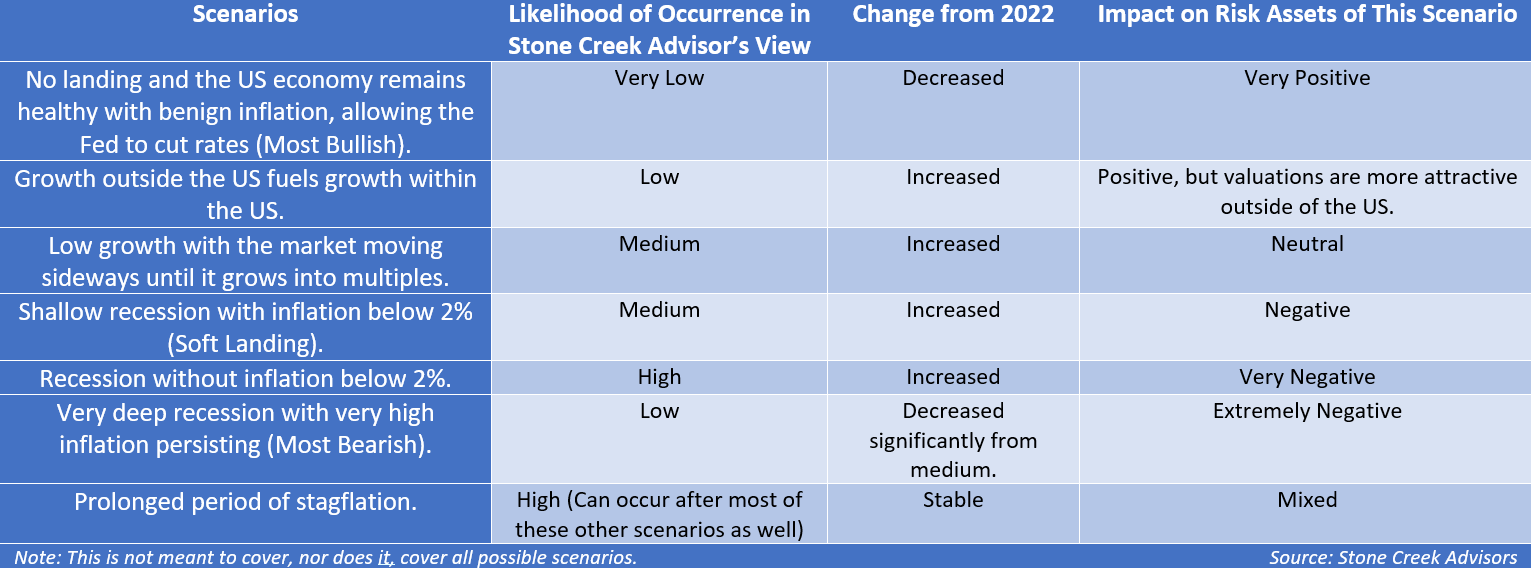

A recession remains the most likely outcome of the current environment in our view. However, in our view, the banking sector turmoil, broader signs of disinflation, and a sharp slowing in our leading indicators have shifted the probabilities of our base case as well as other outcomes. The probabilities of both our most bullish and most bearish scenarios decreased.

The Fed has raised interest rates nine times over the past year. While we do not believe they are likely to cut rates in the near-term, we believe most of the hiking cycle is in the rear-view mirror and a pause later this year is probable. The Treasury market is continuing to price in rate cuts, while the equity market is pricing in a lot of good news. We believe the bets on rate cuts are misguided and the only way that will happen is a severe drop-off in growth.

Our leading indicators suggest the Fed has already slowed the economy sharply. Money supply growth is contracting, Consumption, which comprises 70% of GDP, is showing signs of exhaustion. March retail sales confirmed February’s weak retail sales reading. Inflation has outstripped wage growth for many quarters, consumers have wiped out much of their pandemic savings, credit card balances are at all-time highs, and stimulus has abated. With economic uncertainty rising, consumers appear more cautious. Banks are more cautious too. Tighter lending standards typically precede a drop in loans as well as a recession. Lending standards for both consumers and businesses have been tightening for several quarters. Consumer sentiment remains benign, and consumers have renewed concerns about inflation, according to the University of Michigan survey. Consumer credit card spending has also begun to slow. Personal savings ticked up in the latest month, suggesting consumers are delaying purchases. Data from ports around the US also show a slowing of import activity into the US.

Consumer inflation moderated in March, but not nearly enough to declare a victory. Producer Price Index (PPI) data also came in lighter than expected, printing the largest monthly decrease since April 2020. PPI looks at supplier prices. Companies need to pass disinflation on to consumers for it to translate to slower CPI growth. Companies are less likely to pass lower prices onto consumers when margins are already being compressed by wages and slower economic growth. They will want to ensure inflationary pressures have permanently abated before making that decision. Furthermore, looking under the hood, much of the disinflation was tied to lower energy costs. Oil prices rebounded in April, following surprise OPEC+ cuts. There was also a major seasonal adjustment component to this reading. In summary, however, progress is being made on inflation.

The labor market is also showing signs of cooling. Jobless claims, a leading indicator of the labor market health, were elevated once again and hiring moderated. The number of companies expecting to increase versus decrease hiring has fallen. Labor market tightness is responsible for much of the stickiness in inflation. We believe slack needs to be created in the labor market for the Fed to achieve their 2% inflation target. Longer-term, automation (a secular theme we have exposure to) will bridge this gap.

Two factors that were helping tame inflation have recently reversed. Inflation was likely to have been worse if the US dollar was not so strong. However, the dollar has begun weakening, and the downward pressure may persist due to interest rate policy differentials and lower economic growth. De-dollarization has been discussed a lot recently as countries like Brazil, India, Saudi Arabia, and China adjust to become less reliant on the US dollar. However, the biggest risk to the dollar is the debt ceiling issue in Washington. Defaulting on US debt would be catastrophic to the country and the nation’s currency. While we believe this is a very low probability event, the implications would be disastrous. The second, and more recent, disinflationary factor was energy prices. However, the surprise April cut in output by OPEC+ reversed this. Additionally, much of the disinflationary benefits from goods due to healing supply chains is now behind us. It is likely to be more difficult to bring inflation down to 2% from here.

On the other hand, the banking crisis may have cut off lending more quickly than would have occurred naturally. Lending standards began tightening in 2022. They hit the level that typically precede recessions before the banking crisis even began. Typically, banks tighten lending standards when they worry about credit risks. As banks tighten lending standards, they are less willing to make risky loans. Theoretically, this should slow inflation without the Fed having to raise rates as high. This is especially true today given that smaller and medium sized banks account for a significant portion of commercial and industrial lending as well as consumer lending. They also have a fair amount of commercial real estate loans which could put additional stress on the regional banking sector.

Many companies have depended on near zero interest rates and easy lending standards to stay afloat. If they cannot roll their debt when it comes due because they: a) cannot afford to service the debt at higher interest rates or b) cannot find a bank willing to lend to them then they will likely default on their debt. For companies that have borrowed $1.5 trillion in loans that are mostly floating rate, they are already feeling the impact of higher debt-servicing costs. Thus far, the risk and pain has been mostly limited to interest rate risk. Credit risk is likely to be the next leg. This is a necessary pain, where the economy wrings out excesses to prepare for a new cycle.

Small businesses are the lifeblood of the US economy. The National Federation of Independent Business runs a survey of small business owner sentiment[1] which decreased in March and remains below the long-term average. Business owners concerned about future sales increased noticeably. The two largest concerns were inflation and labor (job openings difficult to fill). This points to a more benign employment and investment picture going forward as these companies don’t have the confidence to invest in their businesses. This is coupled with the new risk that they may experience increased difficulty finding loans to finance investments.

We have written about higher interest rates being a headwind for economic growth and valuations but have not explained why. Treasury yields help set the borrowing costs on debt. When yields increase, borrowing costs for everyone tend to increase. A house a borrower could afford the monthly payment on when 30-year mortgage rates were below 3%, may no longer be affordable to a borrower at a 6.5% 30-year mortgage rate. A company that may have wanted to issue debt to pay for an expansion project will have a higher rate of return hurdle on the project today than it did a year and a half ago. The yield investors will demand for the corporate bond will be higher than treasury yields, which are backed by the full faith of the US government, and the yield required will theoretically increase as the amount of uncertainty increases. Treasury yields are also an input for many investors’ equity valuation models. When yields are low, investors are willing to pay more for stocks. When yields rise, theoretically, the opposite occurs.

We are entering another earnings season. The number of companies that missed earnings expectations increased over the last few quarters. Despite the deterioration in earnings that has already been experienced, future earnings expectations remain robust relative to the headwinds of slower growth, less stimulus, and less pricing power. Furthermore, the significant pre-earnings rally has left the market priced for perfection. In our view, current valuations are only justifiable if the market believes the Fed will thread the needle. With the market valued for this best-case scenario, there is plenty of room for disappointment. We believe the hiking cycle is only likely to end when the economy slows substantially enough for inflation to be squeezed out of the system and that is not a positive for stocks or earnings.

We expect volatility in both the equity and the fixed income market to persist. While Q1 was very strong for stocks, the breadth of the strength was very narrow. It was concentrated in a few of the largest companies in the index. Apple, Microsoft, Amazon, NVIDIA and Tesla were major contributors to the market rally. This narrow breadth is usually not consistent with a sustained rally. Furthermore, gold outperformed the S&P 500 (excluding dividends) in the first quarter, which implies there may be more going on under the surface.

Admittedly, we expected more weakness in the equity market than we received in the first quarter. We were hoping to take advantage of weaker valuations to increase our equity exposure from the low-end of our range. We are tilted towards defensive, quality, value-oriented and inflation beneficiary parts of the market. We began, and plan to continue, building both our small cap and international exposures. The valuations differential in both small caps and international equities is attractive versus US Large Caps. We believe they are more adequately pricing in economic realities and, while we believe we are early, we are coming from significant underweight allocations. We remain heavily invested in short-term treasuries where we are still earning ~5% on an annualized basis to safely wait for opportunities to increase our exposure to risk assets. Our position in gold and exposure to metals miners have been a positive in this environment.

Part of building wealth over the long-term is protecting it when the risks are not in your favor. A lot of uncertainties exist today. We do not have a crystal ball, and no one truly knows what the economy or market will look like six months from now. It is important to be disciplined, keep your long-term goals in mind, and have a portfolio that is personalized to your individual needs and risk tolerance. Do not take more risk than is necessary to achieve your objectives, remain diversified, avoid being overweight in expensive areas of the market when the wind is in your face, and keep dry powder to take advantage of opportunities during times of volatility. We do not believe markets are paying you to take excessive risk today, but things can change quickly. Being nimble and active in today’s environment is essential.

As always, please reach out with any questions.

Kasey