2025 First Quarter CIO Letter: Everybody Freeze

Written April 9, 2025

The magnitude of the tariffs have injected significant uncertainty into the economy and markets as many believed the rates would be revised down. The size and scope of the tariffs are much larger than those imposed during President Trump’s first term and pose serious risk to economic and financial stability.

This will keep companies and consumers frozen, waiting for clarity before spending. For many companies, especially smaller businesses, the only way forward will be to pass tariffs and input costs onto consumers.

In our view, if these tariffs stay on, the odds of a US recession or a painful stagflationary environment is 99.9%. If they are lifted in the next few days, it is closer to 75%.

Protectionism could severely disrupt global supply chains and lead to the formation of new alliances that exclude the US. At its extreme, this shift could signify a changing world order.

A successful transition requires confident and well-functioning debt markets, allowing companies to access capital for these costly changes to their supply chains. Signs of liquidity draining from the system and the sell-off in the long-end of the Treasury curve suggest that, if this trend continues, we may find ourselves barreling towards a financial crisis.

Stronger and alone is not going to be better for earnings, which is what the market cares about.

After years of aggressive monetary easing and excessive government spending, the Fed has been left with an empty toolbox.

Developments since quarter-end have led us to utilize market weakness to cautiously increase our developed international equity exposure.

Despite the market selloff, US equities remain expensive relative to history and earnings expectations are still too high, suggesting we are unlikely to have found the bottom.

As we reflect on the first quarter of 2025, the seismic shifts occurring in global economics and U.S. policy cannot be ignored. Over the past sixteen years, I have been deeply engaged in analyzing long-term trends—with particular interest in the future of U.S. manufacturing, demographics, energy independence, and the evolution of global trade. If we have had the opportunity to sit down for lunch, it is likely we have discussed these views. The culmination of this research is the foundation of Stone Creek Advisors and is the reason we have included gold in every multi-asset class portfolio since the firm’s inception.

These themes have shaped my long-term outlook, but recent developments in U.S. trade policy have pushed us to a critical inflection point that could reverberate for years to come. Those who claim the market will always recover, and that we simply need to ride out the pain, may not fully grasp the potential magnitude of the changes unfolding. For the past fifteen years, buying the dip has paid off, making it difficult to remember more substantial market adjustments could be on the horizon.

Everyone is waiting for President Trump to announce a delay in the implementation of tariffs or a negotiated deal. We are unsure it will materialize soon enough to catch what is possibly a falling knife. Signs of liquidity draining from the system suggest that, if this trend continues, we may find ourselves barreling towards a full-blown financial crisis.

These tariffs are so high they seem unbelievable, injecting further uncertainty into the situation. Now that they have been implemented, the new question is “How long they will last?”. They likely will and should face legal challenges. Every morning since “Liberation Day”, I’ve checked the news, hoping to find them rescinded. At this point, we believe they will not be reversed quickly enough to prevent permanent damage. The uncertainty is paralyzing everyone.

What should be clear by now, is President Trump should be taken at his word. He has been vocal about his love of tariffs and this administration said they were willing to do what it took to get the ten-year yield below 4%. Now, just days after “Liberation Day,” everyone is wondering if it is safe to come out of hiding or if aftershocks are imminent. His far more aggressive than anticipated approach has made it difficult for countries to negotiate. Changing the course too early would risk a loss of credibility which would weaken his future negotiating abilities. Additionally, he needs the GOP to believe these measures are permanent to fund his tax cuts.

Over a Decade of Preparation: My Journey and Perspective

At the start of my career at Manning & Napier, I was tasked with writing the Research Department newsletter which communicated our macroeconomic views to other departments, advisors, and institutional clients. I have always learned and understood best through writing, so this responsibility was a perfect fit. Being at a firm large enough to support deep work on long-term trends so early in my career and having a Managing Director that gave me time and space to read widely, develop my own thoughts, and translate them into papers shaped my career and view on the world. It fueled a passion in me that made me fall in love with this job. I consider myself fortunate to genuinely love what I do every day.

In 2011, I began writing about the US manufacturing renaissance when assigned a project to find a bull case for the US economy. This led me to explore related topics such as demographic shifts, US energy independence, and the rise of automation. I observed the fallout from global supply chains after the 2011 Japanese tsunami and concluded that diversification of supply chain lessons needed to be learned. These issues brewed to the surface again with the pandemic and Ukraine war, highlighting the national security issues as well as inconveniences of relying on other countries. By 2013, I had formed the view that we had reached peak globalization—a trend that had expanded consumer markets, strengthened global growth, compressed inflation, and fueled corporate profitability.

In most normal environments these big, slow-moving, long-term trends do not matter as much. For the past forty years the tailwinds of globalization, demographic dividends, falling corporate tax rates, and falling interest rates have driven strong economic growth. This allowed fundamental stock pickers to do their job without needing to worry about the broader economic picture. However, at points of capitulation, the macroeconomic environment and the shifting of long-term winds become crucial and can overwhelm the portfolios of even the best stock pickers. During these times, having a well-diversified portfolio made up of multiple asset classes is extremely important.

For the past 15 years, markets have mostly moved upward, leading investors to become accustomed to waiting out volatility, buying the dips, and holding concentrated portfolios. The rise of the “Death of the 60/40 Portfolio” headlines should have been a warning sign we were approaching a turning point.

Stone Creek Advisors emerged from these ideas, with Marc and I finding common ground on these long-term trends. We built Stone Creek in 2022 and started meeting everyone we could, armed with a pitchbook that contained the below page that summarized our view:

I have followed these trends closely for over a decade, and I never, in a million years, thought it would come to “Liberation Day”. This day exacerbated the pace and severity of some of these tailwinds changing to headwinds.

“Liberation Day”

President Trump’s “Liberation Day” announcement marks a significant shift in US trade policy, introducing a 10% “baseline” tariff, with higher rates for countries running substantial trade deficits with the US. The formula used divides the US trade deficit with a country by US imports from that country. U.S.M.C.A.-compliant goods (Canada and Mexico) remain exempt, but the 25% auto import tariff announced earlier was reaffirmed. These tariffs follow Trump’s national emergency declaration concerning the US trade deficit, granting him unilateral authority under the International Emergency Economic Powers Act. This is far more significant than the tariffs implemented during his first term, carrying economic and financial stability risks.

The formula behind these tariffs is not reciprocal, lacks economic coherence, and debatably contains an error. [1] Some countries without trade deficits with the US are still subject to the 10% levy. Many of these countries are well positioned in the global supply chain or hold a comparative advantage. Rather than imposing blanket tariffs, a more strategic approach would have been to identify specific supply chains and manufacturing capabilities we want to bring back to the US, followed by targeted efforts to increase competitiveness in those areas. We do not have the necessary infrastructure, skilled labor, and even unskilled labor in place to support such a transition. There was significant groundwork—requiring time, money, and certainty—that needed to be done before something like “Liberation Day” could occur without severely and immediately disrupting US businesses and the broader economy.

For the transition to be successful, we need confident and well-functioning debt markets that allow companies to access capital for these costly changes to their supply chains. Additionally, companies need clarity and assurance that the current course on tariffs will remain unchanged. Writing this letter in this ever-evolving environment has been challenging. I cannot imagine being a business faced with making millions of dollars and months, if not years, of investment decisions today.

This will keep companies and consumers frozen, waiting to spend until these tariffs come off, instead of adjusting to new life with tariffs. For many companies, especially smaller businesses, the only way forward will be to pass tariffs and input costs onto consumers until there is more certainty.

The Dangers and Unintended Consequences of Protectionism

Protectionism poses significant risks to global supply chains and may lead to the formation of new alliances that exclude the US. This shift could permanently damage relationships with long-standing allies, diminish the US’s influence in international trade, and restrict access to crucial consumer markets for American multi-national corporations. As the global economy teeters on the edge of fragility, the U.S., traditionally a source of stability, is now contributing to this uncertainty. Furthermore, such actions increase the likelihood of rising geopolitical tensions.

Countries became overly dependent on the US for growth and protection. The outsourcing of US manufacturing likely went too far, creating supply chain issues, delayed time to market, intellectual property theft, and a loss of control over input costs and quality. Concerns of unfair trade practices and national security implications of outsourcing US manufacturing are valid. China has been ripping us off. Trying to address this directly has been unsuccessful. While this has undermined US economic growth and harmed our middle-class, a blanket tariff that includes our allies is not the appropriate solution.

Efficient global supply chains and fair free trade leverage comparative advantages of different countries, allowing nations to specialize in what they do best, increasing global wealth and reducing inflationary pressures. When inflation rises in one economy and supply constraints arise, sourcing from another country with excess capacity can alleviate the pressure. This is the benefit of diversified supply chains, and it is the reason we had not experienced true inflation for decades until COVID. A more isolated country could lead to recurring inflation, necessitating more frequent interventions by the Fed, potentially shortening economic cycles.

This is economic self-harm on the part of the US, and it will have negative spillover effects on almost every economy and industry across the globe. The flow of goods could be stymied, consumer demand could slow, and business spending and confidence could plummet. In our view, the odds of a US recession or a painful stagflationary environment if these tariffs stay on is 99.9%. If they are lifted before earnings season kicks off, it is closer to 75%. In the long run, this may make us stronger, but it will take a lot of avoidable pain. We think psychological damage has already been done and trade relations may be permanently frayed. The market ultimately cares about earnings and being stronger but alone is not going to be better for earnings.

This May Be All About the Deficit

President Trump has proven he should be taken at his word. He wants to get further tax cuts passed and this may be one of the main motivators behind the size of these tariffs, claiming they will generate $6 trillion over ten years. Tariffs are revenue generating and, by his math, provide the revenue to allow for an extension of the Tax Cuts and Jobs Act (TCJA) which is set to expire at year-end and leave enough room for further tax cuts he wants to enact. If this is his goal, these tariffs will not be removed soon as there needs to be an appearance of permanency for Republicans to count the revenue. Once/if the tax cuts are passed, he may remove the tariffs, if the bond vigilantes allow him to. The passage of this budget blueprint could create a scenario where we are stuck with tariffs on far longer than was intended. Over the past few days this has become less likely though as ultra-conservatives in the US House are threatening to block the blueprint which does not include enough spending cuts in their view. The long-end of the Treasury curve has sold off considerably since the bill passed the Senate, reinforcing the concerns on spending cuts.

Cuts to government spending are necessary, but this amount of spending is going to be difficult to rein in. The updated long-term projections from the Congressional Budget Office (CBO) suggest we are headed for a fiscal crisis. Deficit spending is at unprecedented levels, with the federal government spending $7 trillion annually while only collecting $5 trillion in taxes. The gap is filled by borrowing, pushing public debt to an alarming 100% of GDP this year and an expected 118% by 2035. It is Congress’s job to ensure fiscal responsibility. If they do not, the bond market will impose a harsh reckoning.

Policymakers are acknowledging these risks and as they try to cut government spending, White House chief economist, Stephen Miran said: "The US economy’s challenges in the near term will instead derive from a transition away from reliance on the public sector.” Three-quarters of US job growth over the past couple of years can be tied to “government expenditures and taxpayer subsidies,” Miran said. “So it is a brittle economy as we transition away from that to the private sector.” It is even more brittle now and this isolation may increase the need for military spending and fiscal support.

There is also substantial Treasury debt (as well as corporate and real estate debt) that needs to be rolled over in the next two years that was issued at much yields than today. The Trump administration had a goal of bringing the ten-year yield below 4%, which they succeeded in doing, in order to extend the maturity of this debt at reasonable yields.

In past CIO letters we have referenced the interactive excel worksheet by the CBO that allows you to play with the inputs to see the impact on the deficit.[2] In worksheet tab 3 is the ten-year yield and how it impacts the deficit. Each 10 bps lower on the ten-year yield saves ~$8billion a year in the deficit. If this increases inflation that actually helps the deficit in the short-run in their spreadsheet because it increases revenues in their model.

However, they may have made the situation even worse in making assumptions that:

1) Revenues will increase if inflation increases, which may not be the case if the economy rolls over and tariffs eventually come off.

2) There will be demand for the debt being rolled over.

3) Investors will not be trying to dump the Treasuries.

Since “Liberation Day” credit conditions have tightened quickly and liquidity has been drained. The cost of capital for corporations has become more expensive as spreads have widened and yields on the long end of the Treasury curve began shooting higher on April 7th, undoing that brief period of sub-4% yields on the ten-year. If companies and the country cannot borrow at all, not even at higher rates, bankruptcies (already elevated and increasing) will skyrocket. IPO activity stalled at the end of last week. Over 30% of our Treasuries are held by overseas investors. Will they still want to hold our debt? It is hard to know in real-time, but in the last 24 hours there have been concerns that China is dumping our Treasuries. The full functioning of our debt markets is extremely important for this not to spill over into a larger crisis. We are seeing some concerning signs.

The Federal Reserve’s Conundrum: Stagflation and Recession Risk

The Federal Reserve’s job is becoming increasingly difficult. After years of aggressive monetary easing and high government spending, the combination of rising tariffs, signs of inflation bubbling, weakening survey data, and geopolitical instability presents a scenario where the Fed has been left with an empty toolbox. The recent tightening in credit conditions could exacerbate an already fragile economic landscape, creating an environment where growth stalls while inflation persists. We expect bankruptcy announcements to pick up rather quickly. Once financial stability looks to be enough of a risk the Fed will need to step in.

Survey data has been weakening for months, and the tariffs will exacerbate that trend and potentially impact the hard economic data. Aside from government spending, the high-end consumer, whose spending is highly correlated to the stock market, has kept the economy afloat. The stock market sell-off could become self-reinforcing with slower spending prompting companies to delay capital expenditure plans and reduce hiring, hitting the hard data and earnings expectations and guidance, and then actual earnings. This is when the market will become overly concerned, and it presents the buying opportunity we are waiting for to meaningfully move back into the markets.

To make matters potentially worse, companies stockpiled inventory to get ahead of the tariffs and could now face a slowdown or complete stoppage of demand as consumers and businesses are paralyzed by this uncertainty. This uncertainty is keeping companies from hiring, keeping corporate America from buying back shares of stock (a huge driver of returns the last few years), and keeping them from investing. How do you make informed decisions when you are unsure if anything is permanent? Moving supply chains is costly and slow. Think about how long supply chains took to recover and adjust after the pandemic and what that looked like from an inflation perspective. The difference this time is we cannot stimulate our way out because the fiscal situation is more dire.

Shifting Global Dynamics

For decades, the strength of the US economy has driven global growth and expanded trade. The shift of the US economy from manufacturing to service-based lifted people globally out of poverty. Historically, frontier markets have relied on manufacturing or natural resources to develop. One single day may have changed the course of these countries forever. At this time, we do not feel confident in putting money to work in the emerging markets and have avoided exposure outside of Taiwan.

Fiscal spending is shifting from the US to Europe, sparking investor interest. We slowly began adding to Europe in late December but remained extremely underweight versus our benchmark. Europe began outperforming with the value trade because its companies tilt towards the value factor. We have seen this a few times over the last 20 years, but European outperformance over the US has fizzled out almost as quickly as it started each time. Prior to April 2nd I had several reasons that kept us from further increasing our European allocation:

1) Europe is heavily dependent on Chinese growth, and we were unconvinced the money China was throwing at its economy would successfully prop it up.

2) President Trump had thus far left Europe out of most of the tariff targeting, but Europe was much less innocent than Canada in violating free trade, so we did not think this would remain the case.

3) Negotiations on tariffs may require Europe to move away from China, a country their supply chain and revenue growth is closely tied to.

Since April 2nd, the landscape has changed, leading us to incrementally increase our European exposure during the sell-off. The US may no longer be the prettiest house on the street and international companies may look to competitors outside the US for their supply chain solutions. Investors may also look for other markets outside of the US as yields and valuations in other countries are attractive and the volatility of currencies does not matter if they invest in their home market. This, along with firmer economic data are also reasons we like Japan, where we have continued to increase our exposure to the currency and equity market. While we remain very underweight international equities, this is where we are looking for opportunities in the current environment.

The Road Ahead: Navigating Uncertainty in Financial Markets

This volatility has highlighted the importance of diversification in portfolios. Traditional strategies of always “buying the dip” or concentrating in growth sectors may not work in the same way they have over the past 15 years. Retail investors, historically the last to cut equity exposure, have yet to fully capitulate, leading us to believe the washout in sentiment has not occurred. Most other sentiment signals are showing extreme weakness—put/call data, VIX, and investor surveys. A washout in sentiment alone is a buying opportunity in a healthy correction supported by a healthy economy, but it is not enough during recessionary periods. We need to wait until valuations are discounting reality and/or the hard economic data starts showing pronounced weakness to move to neutral in our portfolios versus our benchmark, neither of which we have seen yet. The bond market is also signaling that things may worsen from here, something that should not be ignored. This combination keeps us cautious on US equities.

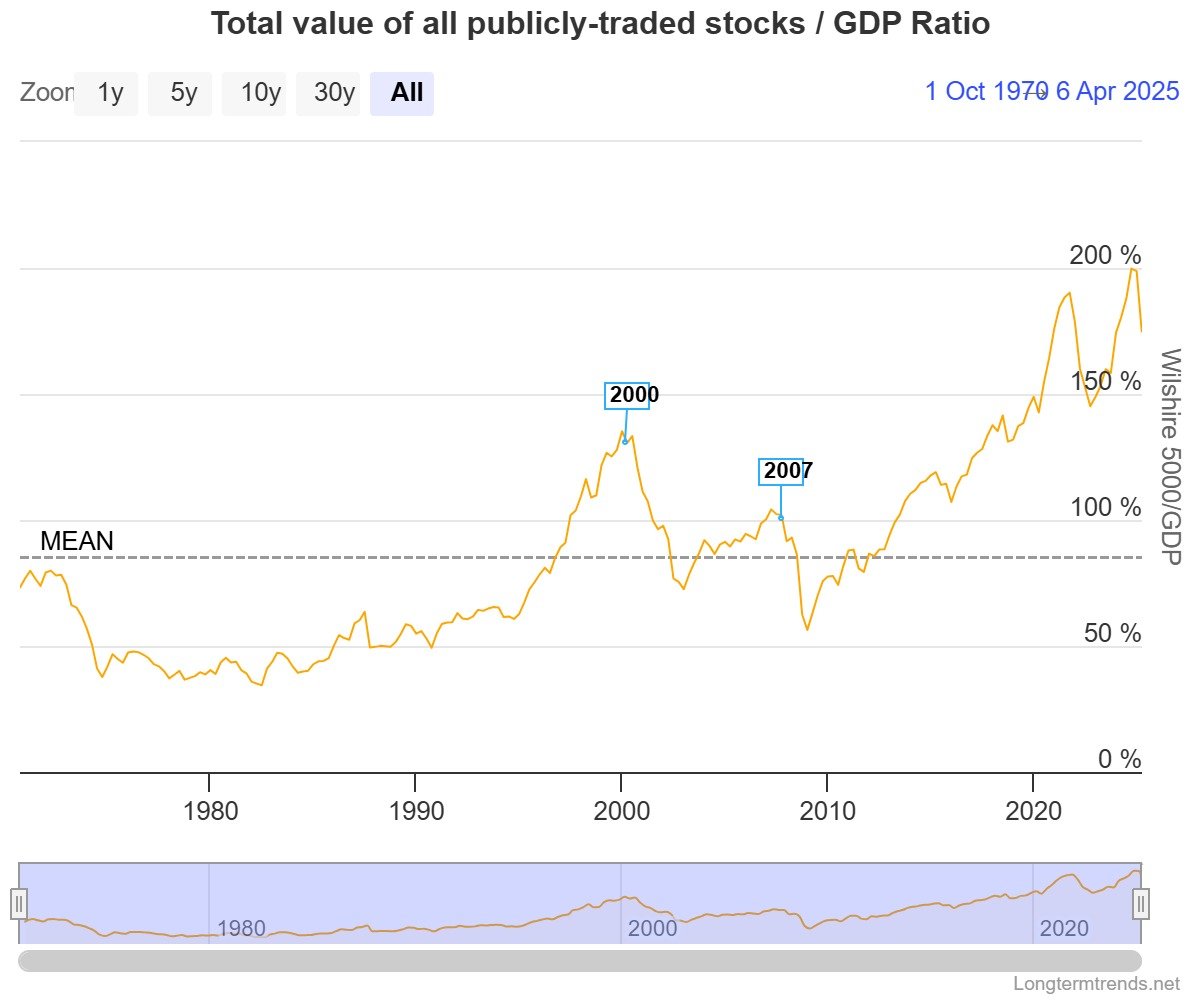

The move toward isolationism is a negative development for both the US economy and markets. Any revolt against US products and US investment will hurt the economy and markets. The increase in input and supply chain costs will hurt earnings growth. Marc uses the Buffet Indicator, the Wilshire 5000 market value/GDP, to highlight how expensive the market is. We reached these recent highs because investors and companies assumed the consumer base would continue to grow. Since the mid-1980’s the trajectory of the trendline has been upwards as the market benefited from the numerous long-term tailwinds. The ratio rose well above the trendline as the US benefitted from being the strongest and most stable economy. What happens in this chart if investors no longer view the US as exceptional and access to the consumer base outside of the US shrinks?

Think about the S&P 500 like a stock. Is the economy (revenue growth) and policy (management) headed in the right direction? If yes, the market should command a higher multiple (how much investors are willing to pay for each dollar of earnings). If the answer is no or uncertain, the US market multiple should revert towards historical levels (slide towards the left columns in the table below). On earnings growth (the rows), is the potential for isolationism cutting the consumer base of goods sold by our country factored into the current growth estimate? Is a rollover in US economic growth factored in? In the S&P 500, we think the answer to these questions are no or uncertain. Even if we do not enter a recession, earnings estimates are high and may need to be readjusted as earnings season resets expectations towards more realistic assumptions.

Proceeding with Caution

The situation remains fluid, and much of this letter could quickly become irrelevant. Most believe some backtracking is inevitable given the severity of the tariffs, but the longer they stay in place, the greater the pain will be. We anticipate a US recession which could be accompanied by inflation, leaving the Fed with limited options. Even if the tariffs do come off soon, the market still needs to recalibrate its earnings expectations. The “Fed Put” may be gone at the same time the “Trump Put” looks non-existent. The script has been ripped up and so has the investment landscape.

We are at a critical juncture where long-term shifts are more important than ever. Our investment philosophy remains focused on a diversified, long-term approach that adapts to the evolving economic outlook and shifting risk/reward dynamics of the market. While we have made selective additions in our portfolios on the sell-off, we are proceeding with caution. We still have substantial dry powder available, and our portfolio betas are well below our benchmarks.

With the rapidly shifting geopolitical and macroeconomic landscape, we are preparing for an environment that may look different from what we have known. Our focus remains on identifying opportunities in sectors with long-term growth potential while ensuring we do not overpay for them.

We will continue to keep you updated as events unfold. Thank you for your trust and partnership during these uncertain times.

Please reach out with any questions.

Kasey

[1] https://www.aei.org/economics/president-trumps-tariff-formula-makes-no-economic-sense-its-also-based-on-an-error/

[2] https://www.cbo.gov/publication/61198

One Seven (“One Seven”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. Services are provided under the name Stone Creek Advisors, LLC, a DBA of One Seven. Investment products are not FDIC insured, offer no bank guarantee, and may lose value.